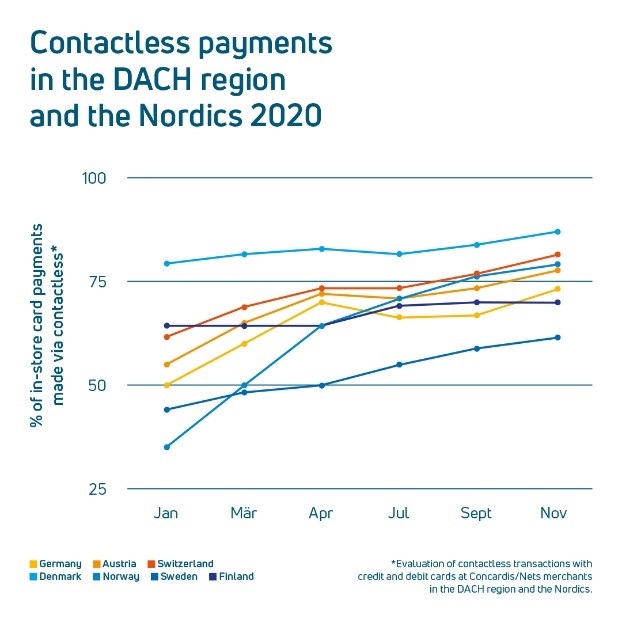

The shift from cash to digital has accelerated dramatically, and Europe is going cashless at a rapid pace with people becoming familiar with the advantages of paying by card or smartphone, and most payments are now contactless (see figure).

E-commerce is on the rise with the online and in-store shopping experience increasingly merging and this has increased consumer demand for convenience.

Consumers expect personalisation, control and immediacy across all channels, delivering integrated and uninterrupted paths to purchase.

As a result, we have seen the rise of Fintechs across Europe. What Fintechs have fundamentally done is to expose how things can be done differently to meet the consumer need for convenience.

We have seen mobile-first and mobile-only challenger banks offering point solutions in cards or payments in general that the consumers would like their banks to offer, and consumers then starting to use alternative providers instead.

A legacy of stability and safety

Unfortunately, many issuers are constrained by old and inflexible legacy platforms, which are hindering their ability to change and to develop at the speed required to meet evolving consumer demands for digital financial services. And the “technology debt” increases year on year. Therefore, many issuers are taking a close look at their technical setup and strategy and evaluate how to achieve a rapid step change.

While this term may indicate the opposite, however, legacy systems have clearly had their advantages and have most often been running stable and secure for many years or even decades.

Therefore, the decision to switch from large, monolithic systems to a far more modern and cloud-based modular approach, even if the old systems are often unnecessarily complex and therefore also vulnerable, comes with concerns. These can be related to the cost of designing and the challenges of migrating data, securing backward compatibility, ensuring full documentation, avoiding vendor lock-in, and eliminating the risk of down-time. All relevant and necessary factors for banks to consider before making the call to change.

Using modular services to transform

One successful approach to solve these issues is to develop a modular ecosystem whereby products and services work together but are not dependent on each other – thereby allowing an issuer to make one change at a time.