By Thomas Voksø Løken, Project Executive, Senior Vice President, Nets Digitisation Services.

Even without the new set of rules the pandemic has laid upon us, digital identification has shown great opportunity and potential. Now, the potential has to be turned into common practice and those who have already done so have gained a lot during recent times.

What is digital ID?

Before going deeper in the possibilities digital ID can offer, it's best to lay down a framework on the topic. To put it simply, digital identity is the electronic equivalent to a physical proof of identity. And like its physical cousin, digital ID can come in different forms: embedded, centralised, attribute based, or based on a trust framework.

Digital ID brings many benefits: the user is readily verified, it can be used to create legally binding digital signatures and for different authentication purposes, and it brings overall security to digital processes. For financial services, banks in particular, digital ID brings unforeseen easiness to different everyday routines like account opening but also help with the fight against fraud.

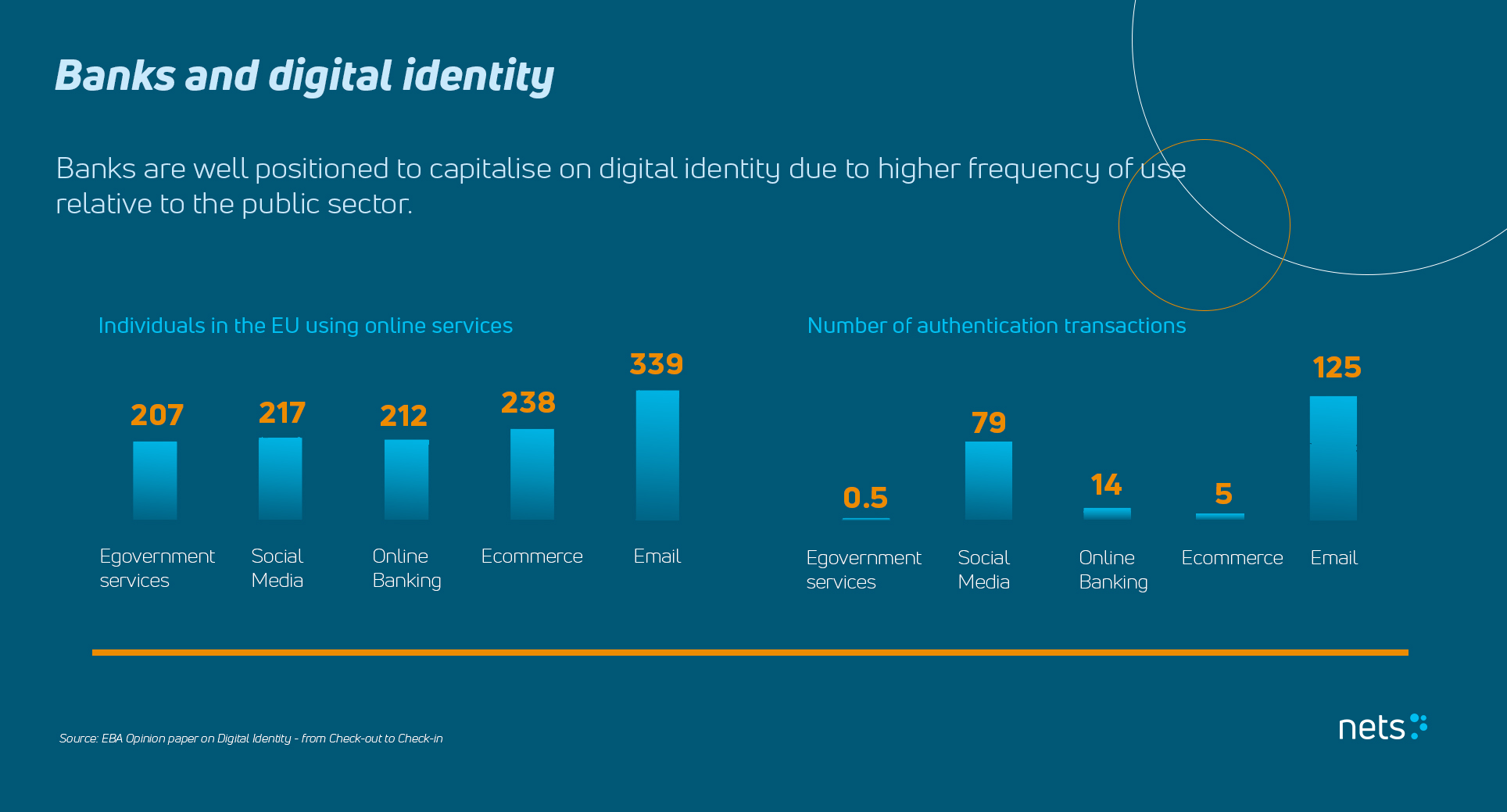

Banks are also in a very good position to turn digital ID into a revenue creator, with great potential of high frequency use and possibilities of monetisation.

High adoption in the North – most of Europe highly fragmented

The Nordics have pretty much walked the path of digital ID adoption. For years, digital ID has been everyday business in the Nordic countries and a way to remove unnecessary friction from a large variety of use cases, where identification is needed, from banking to payments and insurances.

Norway, Denmark and Sweden have adopted a common national digital ID solution (NemID and BankID), in Finland the ID platform shares the same technical backend, but banks act as issuers.

In many countries, the penetration of digital ID is low. The main reasons for this are the low usage frequencies of services chosen for digital ID. Think of a government service: how often do you need to log into your government service? Then compare it with you bank: you use your bank credentials most likely more often than your government credentials to enter the digital tax office.

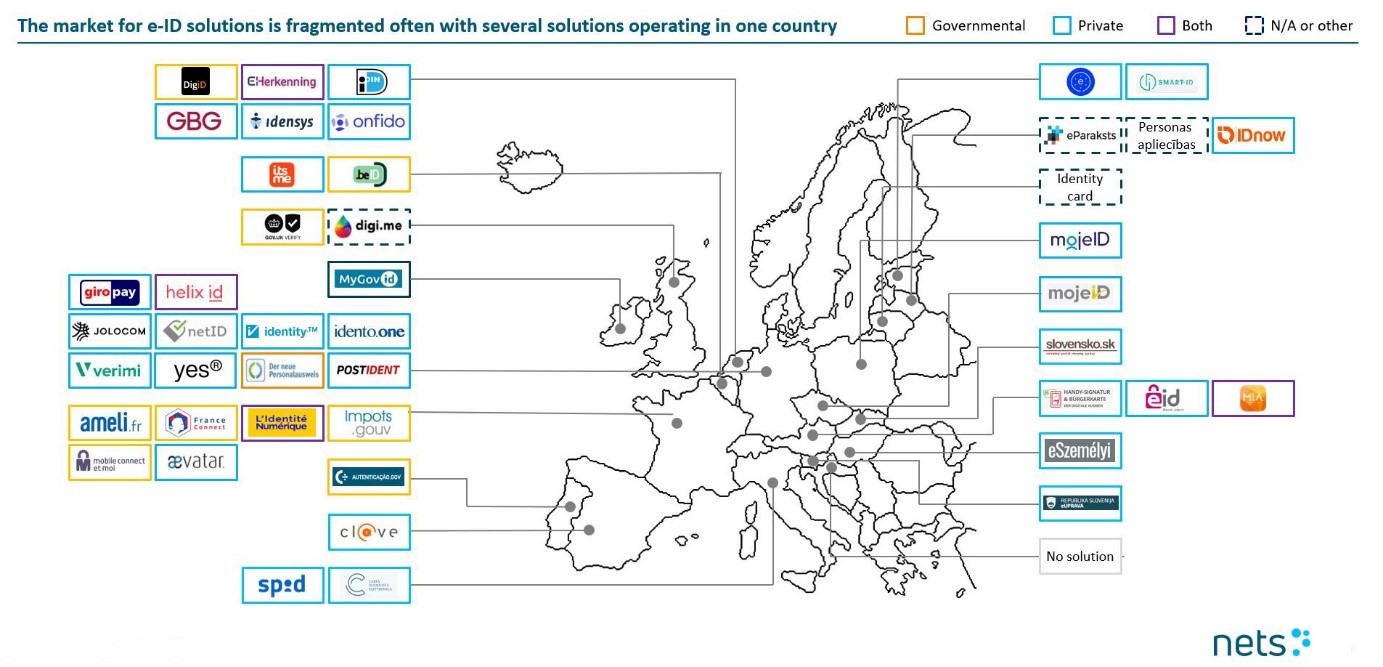

The most common strategy seems to be the rollout of an electronic national identity card, but Europe as a whole is a highly fragmented market with different initiatives ongoing and many, especially the Nordics, using digital ID on mobile devices.

Trust and cost strong drivers

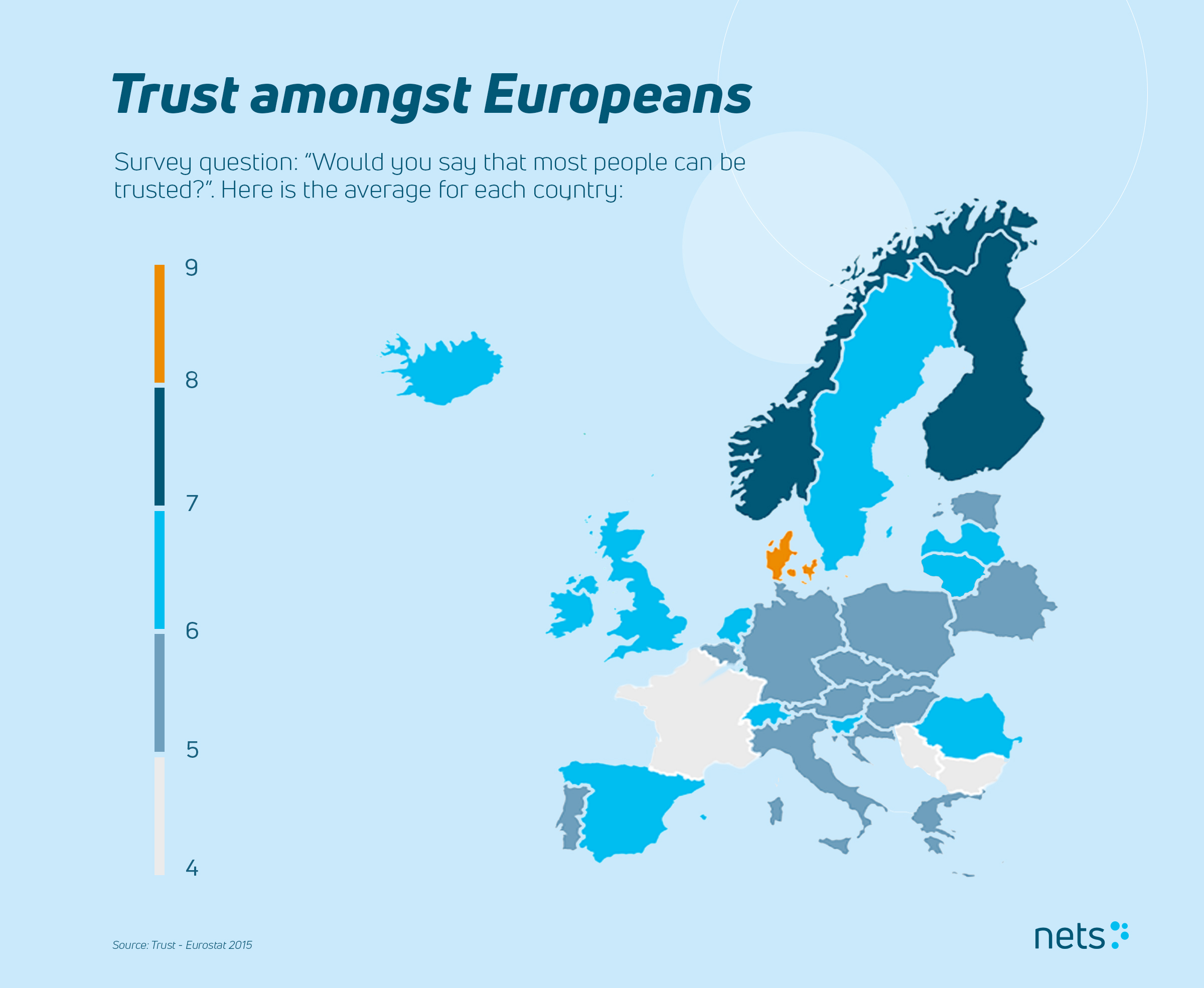

So, what do the countries with a more mature digital ID culture have in common? There are a few points to be found: Successful digital ID launches are most likely backed by public-private partnerships. Cost also plays a significant role, it's more expensive to roll out a digital ID scheme in less digitised markets. And naturally, with a sensitive subject like personal identification, trust is of the essence. The high adoption rates of the Nordics correlate with the sense of trust felt towards other people, but also to the fact, that the ID schemes are tightly connected to banks.

We see that the business case for digital ID is strongest in the banking and financial services where Know Your Customer rules are key to both the business it self and due to regulation. This is also true in the Nordics: in Norway and Sweden the national ID scheme is even named "BankID".

For a digital ID to be successful, the usage has to be enabled as widely as possible, from banks to authorities etc. and provide clear benefits to all sides of the network. Without the vast use cases, a chicken and egg problem will most likely arise. Frequency of use is critical, which is why government issued IDs seldom gain traction.

The future: do we rely on the tech giants, the EU or just ourselves?

The so called GAFA companies have shown growing interest in digital ID in the recent years. Their primary interest lies in collecting data on their users and enhancing the user experience. Secondary, they see a business opportunity in authentications. This is naturally tied to their app ecosystems.

The tech giants aren't the only challenge on the road to a ubiquitous digital identity. As European integration continues, a common European identity has been a topic within the area for a while. History has proven that it does take a lot of time for a common technology or approach to emerge even within a country, let alone in a wider context. In that light, it's hard to see that waiting for such a solution would be a good strategy given the increasing demand and need for digital identification. The most likely scenario for the near future is that individuals will have a few, more context-based ID's, like one to use with your mobile services, another for banking and payments, etc.

Digital identity is a market that has high growth expectations and for good reasons. The time to make a more digital, customer friendly and frictionless user experience is not tomorrow, it's now. And no one needs to act alone, partnering with an experienced player in the digital ID space, like Nets, is a very good way to start.

To learn more, a webinar on the topic is available for watching here. In the webinar, you'll get an in depth view on fraud and which kinds of banks have been the winners during the pandemic.

Read more about Nets digital identification services here.